For investors and traders keen on staying ahead of market trends, tracking S&P 500 futures is a strategic move. The S&P 500, a leading benchmark of the U.S. stock market, serves as a key indicator of market performance. Understanding how to monitor S&P 500 futures provides valuable insights into market sentiment, potential price movements, and opportunities for portfolio management. This article delves into the essential methods and tools for effectively tracking S&P 500 futures, offering a comprehensive guide for those seeking to navigate the dynamic landscape of financial markets.

Understanding S&P 500 Futures

S&P 500 futures represent a derivative financial instrument that derives its value from the underlying S&P 500 index. These futures contracts allow investors to speculate on the future direction of the index, providing exposure to a diverse portfolio of large-cap U.S. stocks. Traders commonly use S&P 500 futures for various purposes, including hedging, risk management, and seeking profit opportunities based on anticipated market movements. Tracking S&P 500 futures involves staying informed about contract specifications, market dynamics, and relevant factors influencing the index.

Utilizing Financial News and Market Analysis

Staying informed about S&P 500 futures requires a keen eye on financial news and market analysis. Reputable financial news sources, such as Bloomberg, CNBC, and financial news websites, regularly provide updates on market conditions, economic indicators, and factors influencing the S&P 500. In addition, market analysis from financial experts and institutions can offer valuable insights into the potential drivers of S&P 500 futures movements. Traders should actively engage with news and analysis to stay abreast of developments that may impact the index.

Real-Time Market Data Platforms

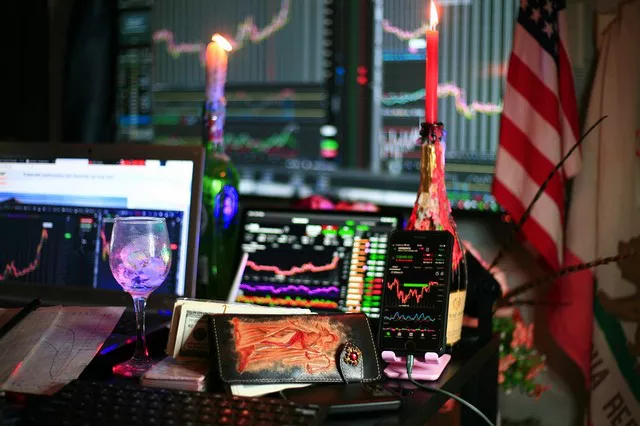

Access to real-time market data platforms is crucial for tracking S&P 500 futures with precision. Platforms like Bloomberg Terminal, Reuters Eikon, and trading software such as thinkorswim provide up-to-the-minute information on futures prices, trading volumes, and relevant market data. These platforms offer advanced charting tools, technical analysis features, and customizable dashboards to cater to the diverse needs of traders. Utilizing such platforms empowers traders to make informed decisions based on real-time data and market trends.

See Also: How do I buy currency futures?

Leveraging TradingView for Technical Analysis

TradingView is a popular online platform that offers advanced charting and technical analysis tools for a wide range of financial instruments, including S&P 500 futures. Traders can use TradingView to create interactive charts, apply technical indicators, and conduct in-depth analysis of price movements. The platform’s user-friendly interface and social features enable traders to share ideas, insights, and technical analysis with a global community. Utilizing TradingView enhances the ability to track S&P 500 futures efficiently and gain a comprehensive understanding of market trends.

Monitoring S&P 500 Index Changes

Since S&P 500 futures are linked to the S&P 500 index, keeping track of changes in the index itself is integral to understanding futures movements. Regularly checking the constituents of the S&P 500, any index rebalancing, and corporate actions affecting individual stocks can provide insights into potential shifts in the index. Changes in the S&P 500 index composition can influence the performance of S&P 500 futures, making it essential for traders to stay updated on any adjustments to the index components.

Utilizing Economic Indicators and Events

Economic indicators and major events play a significant role in influencing the S&P 500 and, consequently, S&P 500 futures. Traders should pay attention to economic releases such as employment reports, GDP figures, and inflation data, as these can impact market sentiment and futures prices. Additionally, geopolitical events, central bank announcements, and global economic developments can contribute to volatility in financial markets, influencing the direction of S&P 500 futures. A comprehensive understanding of these factors enhances the ability to track and interpret futures movements accurately.

Employing Technical Indicators and Chart Patterns

Technical analysis is a fundamental tool for tracking S&P 500 futures and identifying potential trends and reversals. Traders can utilize a variety of technical indicators, such as moving averages, Relative Strength Index (RSI), and MACD, to analyze price trends, momentum, and potential entry or exit points. Chart patterns, such as head and shoulders, triangles, and trendlines, provide visual cues that can assist in predicting future price movements. Integrating technical analysis into the tracking process enhances the ability to make well-informed decisions based on historical price patterns and market signals.

Utilizing Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) that track the performance of the S&P 500 can serve as a convenient tool for investors and traders. ETFs like the SPDR S&P 500 ETF Trust (SPY) closely mirror the movements of the S&P 500 index. Monitoring the price and trading volume of S&P 500 ETFs can offer insights into the broader market sentiment and potential trends in S&P 500 futures. ETFs provide a liquid and accessible way to gain exposure to the S&P 500 without directly trading futures contracts.

Engaging with Options on S&P 500 Futures

Options on S&P 500 futures provide additional avenues for tracking and managing risk. By engaging with options, traders can implement various strategies, including covered calls, protective puts, and spreads, to hedge positions or generate income. The options market on S&P 500 futures reflects market expectations and sentiment, providing valuable information for traders tracking S&P 500 movements. Understanding options strategies and incorporating them into a comprehensive tracking approach can enhance the overall risk management and flexibility in navigating the futures market.

Utilizing Economic Calendars

Economic calendars, available on financial news websites and trading platforms, provide a schedule of upcoming economic events, releases, and announcements. Traders tracking S&P 500 futures can use economic calendars to plan for potential market-moving events and adjust their strategies accordingly. Key events such as Federal Reserve meetings, employment reports, and GDP releases can significantly impact market sentiment and contribute to volatility in S&P 500 futures. Monitoring economic calendars ensures that traders are prepared for important developments that may influence the index.

Accessing Futures Exchanges

For direct engagement with S&P 500 futures contracts, traders can access futures exchanges where these contracts are listed and traded. The Chicago Mercantile Exchange (CME) is a prominent futures exchange where S&P 500 futures contracts are actively traded. Accessing the exchange allows traders to view real-time prices, order books, and trading volumes for S&P 500 futures. Familiarity with the exchange’s rules, trading hours, and contract specifications is essential for those directly involved in trading S&P 500 futures contracts.

Utilizing Mobile Apps for On-the-Go Tracking

In the age of mobile technology, traders can efficiently track S&P 500 futures using dedicated mobile apps provided by financial news websites, trading platforms, and brokerage firms. Mobile apps offer real-time market data, news updates, and charting tools, enabling traders to stay connected to the market while on the go. Whether analyzing charts, receiving price alerts, or executing trades, mobile apps provide a convenient and accessible means for tracking S&P 500 futures from virtually anywhere.

Risk Management and Strategy Adjustment

Tracking S&P 500 futures involves not only identifying potential opportunities but also implementing effective risk management strategies. Traders should establish clear risk parameters, set stop-loss orders, and diversify their portfolios to mitigate potential losses. Additionally, as market conditions evolve, traders should be prepared to adjust their strategies accordingly. Regularly reassessing market trends, economic conditions, and technical signals allows traders to adapt to changing dynamics and make informed decisions to optimize their positions.

Continuous Learning and Market Awareness

The financial markets are dynamic, and successful tracking of S&P 500 futures requires a commitment to continuous learning and market awareness. Traders should stay informed about market developments, engage with industry news, and seek opportunities to enhance their trading skills. Educational resources, seminars, and webinars can provide valuable insights into evolving market trends and strategies. A proactive approach to staying abreast of market changes contributes to a trader’s ability to navigate the complexities of S&P 500 futures with confidence.

Conclusion

In conclusion, tracking S&P 500 futures is a multifaceted endeavor that requires a combination of analytical tools, market awareness, and risk management strategies. By employing a comprehensive approach that integrates financial news, real-time data platforms, technical analysis, and engagement with related financial instruments such as ETFs and options, traders can gain a thorough understanding of S&P 500 movements. Whether utilizing online platforms, mobile apps, or direct engagement with futures exchanges, staying informed and adapting to market conditions positions traders for success in navigating the dynamic landscape of S&P 500 futures trading.